ESG & Corporate Responsibility

Re-evaluating ESG performance post-COVID in the biopharma industry

Table of Contents

- Why companies need to prepare for changing ESG evaluation criteria

- Key COVID-induced trends and what investors expect from companies

- Trend category 1: Potential for competitive edge in ESG ratings

- Trend category 2: Key areas for holistic ESG evaluation

- Trend category 3: Must-have ESG areas reinforced by crisis

- Trend category 4: Basis for competitiveness in ESG ratings

- Outlook

- Author CVs

- Background on the authors' organizations

Why companies need to prepare for changing ESG evaluation criteria

The current COVID crisis affects the economy and virtually every aspect of our lives in a multitude of ways. The pharma industry is in the unique position to help turn the situation around – not just for itself, but also for other industries and even for society as a whole. Through the development of COVID treatments and vaccines by pharma companies, the economy can return to normal, and society can resume social gatherings, travel, participation in events – in short, everything that the pandemic had put on hold. For pharma companies, this responsibility comes with significant risks. But handled well, the situation also holds great opportunities.

Pharma companies have quickly recognized the challenge and taken action in areas such as vaccine safety: In September 2020, biopharma leaders issued their joint pledge in the New York Times to “stand with science” on vaccine trials. But new areas for action will continue to emerge – currently, a heated debate is taking place around access and fair distribution, overshadowed by the threat of compulsory licensing and vaccine patent waivers.

With the crisis evolving in a highly dynamic way, the focus is changing constantly – e.g due to virus mutations that require legislation updates. This article reflects the situation as of April 2021. Many of the identified trends are expected to persist in the long term, but others may prove to be fleeting.

In light of the rapidly evolving circumstances during the COVID crisis, external stakeholders from regulators to activists are demanding pharma companies take action on various crisis aspects. Among these stakeholders, investors are a group of particular concern as they are re-examining their criteria for evaluating pharma companies. This document explores how the pandemic will likely influence the way capital markets view ESG performance, i.e. particularly how ESG ratings will be adapted. Aiming to understand changing investor perceptions, the authors of this article began researching financial market participants’ current publications. The findings were then verified through personal exchanges with experts from e.g. Domini Impact Investments, Sustainalytics, and the Access to Medicine Foundation. This was supplemented with pharma industry participants’ insights. Since ESG ratings represent a vital source of information for investors building their portfolio strategies, particular attention has been paid to ESG ratings. ESG rating scores will reflect how well pharma companies manage to turn the COVID crisis into opportunities.

Pharma companies will need to anticipate updates to ESG frameworks triggered by the COVID crisis. Based on these updates, companies will need to adapt key business strategies and management approaches. In addition, corporate reporting will need to be adjusted accordingly. But how to do this successfully? This article will attempt to provide answers to the following questions: Which crisis aspects should pharma companies prioritize? How should they manage these trends and communicate relevant activities to the satisfaction of ESG experts and investors?

But while thinking about ESG ratings and issue prioritization, companies should bear in mind that investors are increasingly applying holistic evaluation strategies that go beyond ESG ratings. Ad-hoc responses to ESG requests will no longer be sufficient, and companies need to go deeper. This includes continuous trend monitoring to inform corporate strategy, risk management, as well as revisions of business model and governance structures.

Key COVID-induced trends and what investors expect from companies

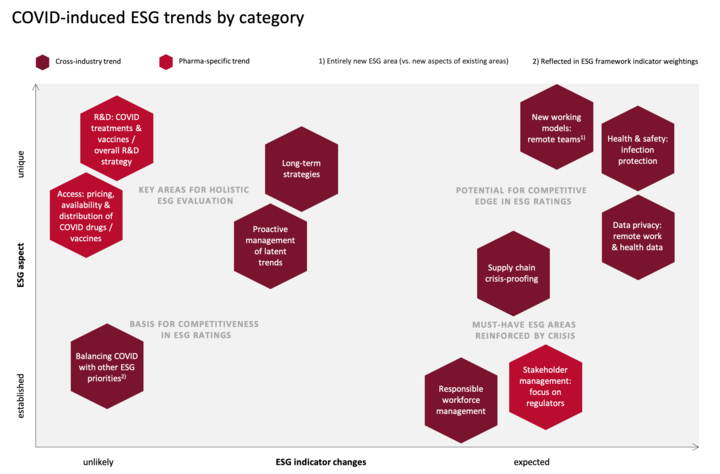

The research conducted for this article yielded a number of relevant ESG trends that have emerged in connection with the COVID crisis. For prioritization purposes, the trends can be arranged into the following categories: 1) Unique to COVID vs. well-established from previous crises, and 2) likely vs. unlikely to lead to ESG indicator changes. The below matrix shows where each trend falls on the spectrum.

The above matrix allows the deevelopment of a rough roadmap for addressing the trends:

Any trends in the upper right-hand corner should be prioritized, as they are both new and can be expected to lead to changes in ESG rating frameworks. By focusinig on these trends, companies can potentially gain a competitive edge in ESG ratings.

Trends in the upper left-hand corner are equally unique to the COVID crisis, and although they are less likely to be reflected in new ESG indicators, they constitute just as vital a factor in investors’ holiistic evaluation strategies. With ESG rating scores far from being investors’ only source of information, strong performance in these key areas may well be the deciding factor that sets some pharma companies apart from competitors.

The lower half of the matrix represents trends that are well-established both in ESG ratings and in companies’ ESG strategies. Still, they are worth reconsidering in light of the crisis: COVID has brought out certain aspects of existing trends. And it is forcing companies to think about how COVID-related requirements can be addressed while keeping in mind other ESG priorities that were already in focus prior to the pandemic and that should not be lost from sight.

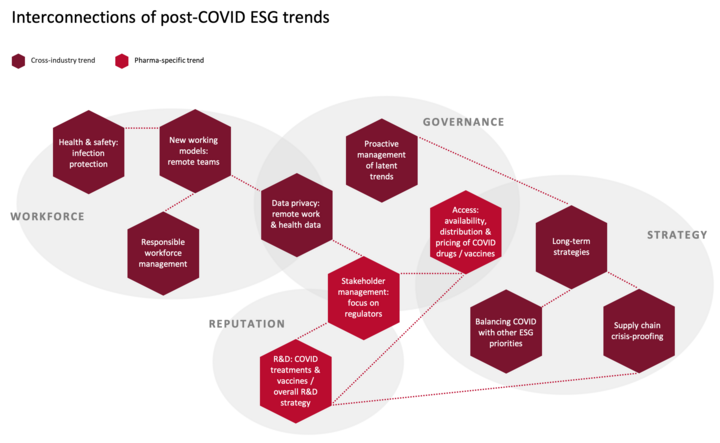

Post-COVID ESG trends are highly interconnected

While the matrix categorization of trends above is intended to provide prioritization guidance to companies, it is important to keep in mind that these trends are closely interrelated and should not be viewed in isolation. One example of connectios between trends is the link between new working models and data privacy: With increasing numbers of employees working remotely, the use of digital communication formats vulerable to data privacy issues is equally rising. The connections between topics are visualized below and will be explained in more detail in the following trend sections.

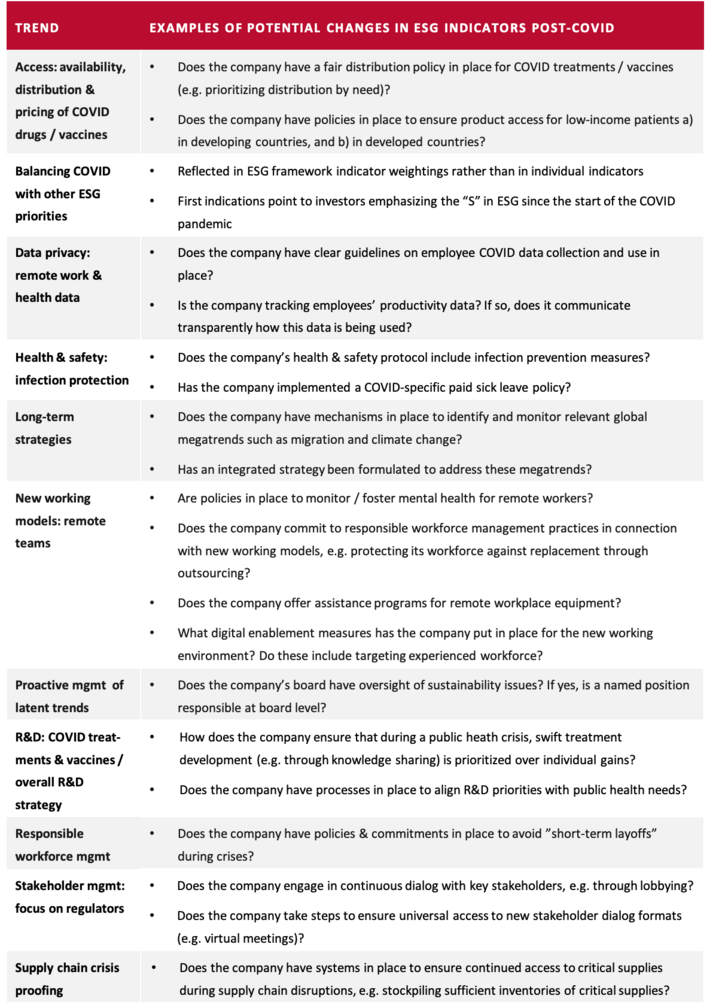

Most of the trends introduced in this article apply across industries, but a few are specific to the pharma industry. The following sections will introduce each trend and outline the implications that follow from it, as well as the relevant actions that investors are expecting from companies. In addition, the overview table “Examples of potential changes in ESG indicators post-COVID” summarizes the trends’ potential manifestations in ESG indicators. It should be noted that each of the identified trends has complex dynamics that could fill a book. This article can only very briefly summarize the trends and provide a few examples of their expected effects. To be fully understood, each trend and its implications would need to be interpreted in the context of e.g. sectorial and geographical differences.

Trend category 1: Potential for competitive edge in ESG ratings

This trend category is shown in the upper right-hand area of the matrix. It includes new working models, health & safety, and data privacy in the context of remote work and health data. All of these trends are uniquely related to COVID, and represent new challenges that companies are expected to master.

Data privacy: remote work & health data

Trend

During the COVID crisis, data privacy is gaining importance in different contexts.

The first one is remote work: With employees increasingly working from home, employers may track productivity data to keep tabs on their employees when they cannot be personally monitored at the office. But not only employee data is at stake. Remote work also leads to increased employer data confidentiality concerns, e.g. due to cyber-attacks on virtual meeting providers, or when confidential conversations are held near open windows of employees’ homes.

Another aspect of data privacy concerns is the use of workplace coronavirus tracing apps. Data from these apps can be sent directly to employers, bypassing employees. Employers may exert pressure to use such tracing apps as a condition of continued employment.

Implications

Employees may be concerned about employers’ access to their productivity and / or health data, but have no means of protecting themselves without putting their employment status at risk. Employers, on the other hand, are in need of ways to effectively protect company data against leaks or cyber-attacks with employees working remotely.

Expected action

Responsible management and clear policies regarding data collection and use will be required of companies. This includes

- transparent guidelines on the collection and use of employee productivity data.

- clear policies on health data management in connection with workplace COVID tracing apps.

Health & safety: infection protection

Trend

Health & safety is traditionally a focus area for industries with high numbers of work-related accidents and fatalities, such as construction or mining. But with COVID, health & safety is gaining a new dimension and broad relevance in virtually all industries, including pharma. Health & safety now extends to protecting employees against workplace infection. This is of particular concern for blue collar positions such as production work (e.g. pharma) and frontline activities (e.g. retail), where physical presence is required and manual labor unavoidable.

Implications

Most industries, including pharma, will need to move health & safety up on their agenda and invest in protecting their workforce. Employers may become vulnerable to lawsuits over neglecting infection protection measures. Furthermore, companies need to bolster resilience to increased absence rates.

Expected action

Companies will be expected to

- protect their workforce against workplace infection, e.g. through updated health & safety policies and investments in personal protective equipment.

- put in place adequate sick leave policies to ensure that potentially infected workers can stay at home without economic pressure.

- develop staffing models that are resilient to increased absence rates.

New working models: remote teams

The COVID crisis is accelerating the existing trend toward digital and flexible workplaces. Employers are increasingly facilitating remote work, with the aim of limiting virus exposure risks.

Trend

The COVID crisis is accelerating the existing trend toward digital and flexible workplaces. Employers are increasingly facilitating remote work, with the aim of limiting virus exposure risks.

Implications

The pandemic has become a catalyst for accelerating cultural change. Companies are increasingly embracing new forms of work to accommodate existing workforce demands. For example, young families may expect flexible and remote work options to balance work with family life, or retirees may prefer working part-time without the need to come to the office.

But new working models also lead to potential issues. For one thing, with remote work a job is no longer tied as closely to an office location. For employers, this may decrease employee retention rates, because changing employers involves less effort on the employee side. For employees, this may result in decreased employment security as outsourcing becomes easier.

Another problematic aspect of remote work is that the trend may aggravate existing inequalities. This can be illustrated by comparing an office worker’s situation to that of a retail store clerk: Office workers are generally better educated and as a result receive higher salaries. Thanks to remote work, they are now also at a lower risk of workplace infection.

Finally, remote work can trigger new issues related to mental health (e.g. through lack of personal contacts), remote workplace safety, and data privacy.

Expected action

Companies will be expected to enable remote work where possible, while

- committing to protect jobs against outsourcing risks.

- safeguarding employees’ mental health and data privacy rights.

- ensuring fair compensation (e.g. in the form of a risk bonus) for employees that cannot work remotely, such as production workers.

Trend category 2: Key areas for holistic ESG evaluation

This trend category is shown in the upper left-hand area of the matrix. It includes access, long-term strategies, proactive management of latent trends, and R&D. These trends are again unique to the COVID crisis, but less likely to lead to ESG indicator changes. Nonetheless, investors will consider these areas in holistic ESG evaluations and companies will do well to prepare their stance on the related issues. Notably, this trend area includes two of the major pharma-specific trends – access and R&D. How pharma companies handle these trends will have a long-term impact beyond investors’ evaluations: All of society is watching, and the entire industry’s reputation hangs in the balance.

Access

The full weight of access and pricing challenges is for the first time being broadly experienced by western countries alongside low- and middle-income countries. This lack of access to life-saving therapies is a deeply emotional experience that is not likely to be swiftly forgotten. Pharma companies need to be prepared for discussions around availability, fair distribution and pricing to continue with renewed fervor beyond the pandemic.

Beyond ethical considerations, making vaccines widely available across the globe is a matter of safety for all countries. The pandemic can only be truly overcome and the threat of new variants contained once global “herd immunity” has been achieved.

Access trend 1: Availability and fair distribution

Trend

With COVID treatments and vaccines, pharma companies hold the key to a way out of the pandemic. This position comes with stakeholder expectations that center around availability and distribution. Most products are patented and come with a price tag that is too high for many populations in low-income countries but also parts of the population in developed markets. Access has already become an issue across all countries including the developed ones. Vulnerable population groups are growing due to unemployment and resulting losses of healthcare benefits, as well as an ensuing housing crisis.

Implications

Pharma companies need to take a stand regarding fair distribution. They need to define equitable mechanisms to make treatments and vaccines available to all patients. This will be complicated by different stakeholders pursuing conflicting interests: While governments may aim to put access for their citizens first, shareholders will generally prefer treatments going to the highest bidder. Other stakeholders, e.g. scientists or NGOs, demand access by level of need (i.e. prioritizing healthcare workers or patients with underlying conditions), and equal distribution between developed and developing countries.

Access trend 2: Pricing

Trend

The COVID crisis is highlighting stark differences in stakeholders’ expectations regarding product pricing. On the one hand, investors expect strong excess returns. This is illustrated by the fact that stock prices have risen remarkably in anticipation of successful vaccine and treatment development (and how sharply they have declined following US president Biden’s proposed COVID-19 vaccine patent waivers). Society, on the other hand, expects COVID treatments and vaccines to be affordable for all patients. NGOs go even further in demanding donations of COVID treatments and vaccines. Particular price pressure is on companies that have received government funding.

Implications

Pricing issues are the past, present, and future of pharma companies. The long-standing pressure from different stakeholders regarding product pricing and distribution considerations is about to reach its peak. Now, a precedent will be set with the pricing of COVID treatments and vaccines. After this immediate issue has been addressed, broader discussions about pricing are to be expected in the future. The fundamental question behind this debate will be what constitutes “fair” pricing. For example, in cases where companies receive public R&D funding, the expectation will be product prices should reflect this.

Price pressure will intensify for pharma products in general, as governments may increasingly refuse to pay for specialized high-margin drugs (e.g. cell and gene therapies) in order to keep sufficient budget for “common” diseases (e.g. pneumonia).

Expected action (access trends 1&2: Availability and fair distribution, pricing)

Pharma companies will be expected to

- take a stand regarding fair allocation, considering need in addition to purchasing power. This is becoming increasingly relevant for developed countries (e.g. minorities in the US).

- develop responsible access and price-setting strategies, ideally in close dialog with regulators:

- Pharma companies need to develop access frameworks that are country-agnostic, but income-specific.

- Balanced pricing models will be required beyond the pandemic.

- balance conflicting stakeholder interests around access (e.g. shareholders vs. society)

Beyond these distinct requirements, many open questions remain with regard to access. Pharma companies will need to continuously strive for contributing to solutions in the following areas:

- Should life-saving therapies be viewed as a “common good”, accessible to and affordable for all patients in need?

- And if so, what will new incentive structures for pharma companies need to look like?

Long-term strategies

Trend

The pandemic has been a wake-up call for investors, highlighting that global developments can have an immediate impact on businesses. Prior to COVID, a number of global megatrends had already been impacting the economy and the pharma sector in particular but received less immediate attention. Examples of these earlier trends are climate change – leading to changing global disease patterns, and migration – causing shifts in patient populations. The new megatrend “pandemic” is bringing communicable diseases back onto pharma companies’ strategic agenda.

Implications

Investors are now focusing their attention on evaluating who is prepared for the future and who performs well in preparing for additional challenges. They are analyzing which companies have integrated strategies in place to address existing or emerging megatrends. Pharma companies will be assessed by how they prepare to position themselves post-COVID. R&D strategies and pipelines need to be reviewed and the role of access reevaluated as a business driver. Entire business models will need to be revised, as most large pharma companies currently pursue high-margin specialty treatments for small patient groups. Infectious diseases such as COVID, on the other hand, require treatments for large patient populations at moderate drug price levels.

But investors are also looking past the pandemic to determine whether companies are monitoring future trends and developing integrated strategies in response.

Expected action

Investors will expect companies to

- develop integrated strategies and conduct business model reviews in response to COVID, e.g. refocusing on drugs for larger patient groups but with lower margins.

- monitor future trends more actively and formulate appropriate responses.

Proactive management of latent trends

Trend

The pandemic should not have come as a surprise. But prior to the COVID crisis, warnings of a latent pandemic threat were not taken up by top-level management. According to industry experts, the same is true for other trends such as anti-microbial resistance, or the impacts of climate change on global health.

Governance mechanisms are currently lacking to ensure proactive trend identification and strategy formulation. Companies currently tend to address topics reactively, usually only after a major external stakeholder raises concerns, or the trends have already developed into immediate threats.

Implications

Demands are rising for companies to proactively manage latent trends. They need to prepare not just for the next pandemic, but also for other dormant risks of similar magnitudes. For example, pharma companies will be expected to review their business models considering the effects of climate change on human health, including heat-related health impacts or changes in the geographic distribution of vector-borne diseases such as malaria.

This trend category in particular will be evaluated holistically by ESG investors: In addition to ESG ratings, investors will refer to materiality and risk assessments, as well as forward-looking statements regarding the corporate strategy and business model. In addition, investors will consider information gained through direct engagement with companies.

There are several specific steps that pharma companies can take toward proactive risk management. First, they should establish dynamic materiality assessment processes in order to identify emerging trends in real-time. Then, expertise needs to be mobilized from within companies, but also across the industry, to identify potential future threats. The insights that are gained through both of these processes need to be made accessible to company leadership, e.g. through trainings and workshops, and through including sustainability experts at board-level. The findings further need to be integrated into corporate risk management and reporting, and corporate strategy as well as business models should be adjusted accordingly. Information on actions taken to address relevant trends again needs to be publicly disclosed.

Expected action

Companies will be expected to

- engage in continuous, ideally “real-time” trend monitoring, e.g. through dynamic materiality assessments and stakeholder engagement.

- revise governance structures to ensure integration of sustainability at the highest levels, i.e. install sustainability experts at board level.

- develop solutions to address emerging or latent threats.

- establish processes for incorporating findings into corporate strategy and risk management, business model development, and reporting.

R&D

In this crisis, pharma companies find themselves in a unique position. Not only is pharma one of the few sectors thriving during the pandemic, but through treatments and vaccine development, pharma can help other sectors to get back to normal. A side effect of the current spotlight on the pharma industry is the exposure of underlying issues in companies’ R&D strategies and business models. This will remain a key discussion point even after the pandemic.

In the short term, pharma companies need to focus on COVID treatment and vaccine development and registration. But in the long term, R&D strategies and business models will need to be scrutinized and adapted.

R&D trend 1: Vaccine development & registration

Trend

Competition is fierce around COVID treatment and vaccine development. This article focuses on vaccines, because vaccines have recently become available and dominate the current debate. But challenges are similar for both preventive and curative products, and the majority of issues raised in this section apply to treatments as well as vaccines. The focus is on speed; R&D cycles are being compressed as far as possible, and approval processes are progressing with unparalleled swiftness. The focus is on speed; R&D cycles are being compressed as far as possible, and approval processes are progressing with unparalleled swiftness.

While companies are competing in the race to the finish line, few can accomplish this task on their own. Collaboration is needed for R&D, manufacturing, and distribution. Large peers are bundling their resources (e.g. Sanofi and GSK), while others are partnering with small peers for scale-up support (e.g. Roche and Regeneron). Companies with large manufacturing capacities lend a hand to peers for vaccine production (e.g. Novartis manufacturing Pfizer / BioNTech vaccines).

Although products are already on the market, development and registration of new products is ongoing. For vaccines, additional orders are to be expected countries have completed their initial immunization campaigns. The volume and frequency of future orders will depend on two factors: First, the duration of immunization protection and second, existing vaccines’ effectiveness against variants.

Implications

Investors tend to prefer established pharma companies that project realistic development timeframes and have established relationships with governments and regulators to speed up the registration process.

Pharma companies aiming to emerge from the crisis as winners need to effectively manage the following risks and harness opportunities: Reputational risks are a threat to individual companies focusing on fast solutions. Reputational damage can spread to the entire industry in case of scams or failures that involve high costs for patients. Reputational opportunities can be gained for example through R&D collaboration and examples of pharma companies placing the goal of ending the pandemic ahead of immediate business interests. Pharma companies further have the chance to build trust by making development processes transparent.

Furthermore, societal perception of the pharma industry can experience a boost or become permanently damaged, depending on how companies balance shareholders’ R&D interests with public expectations. R&D cycles will not return to normal after the crisis, and emergency approvals will become more frequent in situations of urgent public health needs. Shareholders will push for swift R&D cycles that decrease time to market and allow for extended sales periods under patent protection. The public, on the other hand, will expect companies to prioritize product safety over speed. Maintaining public trust with accelerated R&D cycles will therefore require increased transparency on development and approval processes, as well as clear communication of potential risks and product quality issues

R&D trend 2: Overall R&D strategy & business models

Trend

COVID is highlighting the fact that many established pharma companies have been focusing on non-communicable diseases – i.e. small patient groups and high margins – rather than vaccines or infectious diseases – i.e. large patient groups and smaller margins.

Implications

An ongoing post-crisis debate can be expected to focus on whether public health needs or business opportunities should be driving pharma R&D. Governments may push the transition toward a stronger public health needs focus by reserving a larger portion of public health spending for the treatment of “common” infectious diseases affecting large parts of the population. Companies consequently need to reassess current R&D strategies and business models. They need to decide which therapeutic areas should be brought into focus and how this can done profitably.

Expected action (R&D trends 1&2: Vaccine development & registration, overall R&D strategy & business models)

Pharma companies will be expected to

- collaborate in the areas of R&D, manufacturing, and distribution – not only to solve the current COVID crisis, but also to address other pressing issues such as anti-microbial resistance.

- uphold R&D quality and ethical standards in the face of condensed R&D cycles.

- building trust with the public through transparent development processes, responsible balancing of accelerated development timeframes with patient safety, and transparent communication of potential risks or any product quality issues.

- design future-proof R&D strategies and business models, balancing shareholder demands with public health needs.

But many open questions remain in this area, mainly centering around accelerated R&D timelines and public health needs-focused R&D strategies:

- Accelerated R&D timelines

- What effect will current, accelerated R&D timelines have on post-pandemic R&D cycles?

- Should shareholders push for accelerated timelines, and what implications would this have for public trust in product development processes?

- Public health needs-focused R&D strategies

- What could incentive structures look like for public health needs-focused R&D engagement?

- Can markets be developed with these products, and what can successful business models look like?

Trend category 3: Must-have ESG areas reinforced by crisis

The matrix’s lower right-hand corner shows well-established ESG areas that need to be reevaluated in light of the crisis. These trends include supply chain crisis-proofing, stakeholder management with a focus on regulators, and responsible workforce management. While ESG experts are highly familiar with all of these topics, their importance is being reinforced by the COVID crisis.

Responsible workforce management

Trend

Companies facing economic difficulties during the crisis can be forced to decide whether to reduce their workforce. For the pharma industry, this is less of an immediate issue, since a return to pre-crisis production levels was never in doubt. Thus, no large-scale layoff threat exists for pharma companies in general. However, the pharma industry is closely linked to other industries such as chemicals, animal health, or crop science. In addition, companies with diversified portfolios (e.g. Bayer) might be directly impacted.

Two types of layoffs can be seen: The first type are “real” layoffs that occur due to crisis-induced restructurings. The second type are short-term “lockdown layoffs” where companies are laying off workers only to re-hire them once conditions improve.

Implications

The “real” restructuring layoffs are not a new phenomenon. Investors feel that this effect is covered in existing ESG indicators as a consequence of e.g. the 2008 financial crisis. Short-term layoffs during lockdowns, on the other hand, are unique to the COVID crisis. Such layoffs damage companies’ reputation, and may thus not only impede companies’ ability to attract top talent after the crisis, but also lead to changes in ESG ratings and investors’ assessments.

Expected action

During crisis-induced restructurings and layoffs, maintaining good communication with the workforce is key. As in any crisis situation, affected companies will need to strengthen union relationships as a conflict resolution mechanism. Should layoffs prove unavoidable, companies need to ensure that responsible termination procedures are applied.

Beyond this, during the COVID crisis companies will be expected to

- avoid short-term “lockdown layoffs”.

- strengthen union rights and freedom of association.

Stakeholder management: focus on regulators

Trend

COVID is raising an extraordinary number of complex new issues. One example is the task of supplying vast populations with COVID vaccines within the shortest possible timeframe. Decisions need to be reached quickly, and many times broad sets of stakeholders need to be considered. While different stakeholders raise a multitude of – sometimes contradicting – demands and expectations, governments and regulators usually play a key role in the decision-making processes.

Implications

In this fast-paced situation, it is becoming all the more essential for companies to be heard, so that well-informed decisions can be made by regulators. In the vaccine supply example above, a highly undesirable outcome for pharma companies would be compulsory licensing. Such a decision by governments could result in losses to all parties involved: From potential product quality issues harmful to patients’ health, to the undermining of pharma companies’ future innovation incentives, and finally a lack of knowledge transfer to manufacturers – something that would take place under voluntary licensing arrangements.

By actively engaging with stakeholders, particularly through lobbying, more beneficial outcomes can be achieved. To stay on the vaccine licensing example, engagement with policymakers can help identify the main limiting factors affecting production volumes – apart from patent protections, these factors could start at more basic levels such as limited manufacturing capacity or availability of raw materials, as well as supply chain challenges (e.g. cooling requirements). Aligning on the best approach for addressing these factors will almost certainly yield more beneficial outcomes than governments unilaterally imposing compulsory licenses or patent waivers.

From an investor viewpoint, good government relations are a key asset, because major stakeholders’ decisions can have long-lasting effects on the way pharma companies do business. Smaller companies may become acquisition targets for their good relationships with regulators.

Expected action

Pharma companies will be expected to focus on

- active and continuous engagement with stakeholders, in particular regulators.

- employing new stakeholder communication formats – e.g. digital, multi-stakeholder exchange formats.

- ensuring broad stakeholder access to and participation in new dialog formats, with the aim of reaching a well-balanced set of stakeholders.

- transparent communication of considerations leading to the prioritization of certain stakeholders’ demands over others’.

Supply chain crisis-proofing

Trend

Various pandemic effects are leading to supply chain disruptions. Lockdowns are one of them: As supplier companies are forced to close down operations, supply runs short on some raw materials. National interests may aggravate the situation: As demand is increasing for certain products (particularly in the pharma industry), national interests may be put first over supplier relations. Finally, regulation plays an important role as export restrictions are being placed on certain limited supplies. To make matters worse, many companies are operating with just-in-time delivery strategies and have downsized storage capacity accordingly, removing any buffer to absorb even moderate supply chain disruptions.

Implications

Pharma companies will need to rethink their supply chain strategies in preparation for the next crisis. The two main choices are risk spreading through further geographic diversification, or going in the opposite direction by returning to a national or regional focus, allowing for shorter delivery routes. Further options include the securing of additional back-up suppliers, preferably from low-risk regions, as well as increasing critical supply stocks, thereby reprioritizing risk management over cost.

Expected action

Many of the supply chain-related choices expected from companies involve trade-offs and potential ethical dilemmas. Companies need to take action on

- increasing supply chain resilience against pandemic impacts, while upholding third-party standards.

- securing and stockpiling critical supplies, incurring increased costs.

But open questions remain, e.g.

- How will increasing the supplier base affect companies’ ability to consistently enforce third-party standards? Potential ethical dilemma: This risk needs to be weighed against companies’ ability to reliably supply life-saving products.

- What are the cost effects of product stockpiling requirements in preparation for the next pandemic?

Trend category 4: Basis for competitiveness in ESG ratings

The final trend category consists of only one issue, namely the need to balance COVID with other ESG priorities. This need for balancing and prioritizing ESG initiatives is hardly unique to the COVID crisis, and it is not expected to affect ESG rating indicators as such – although any shifts in rating agencies’ priorities would be reflected in the weighting of certain indicators or indicator categories. A well-balanced ESG approach constitutes the basis for companies’ competitiveness in ESG ratings, because only through effective focus-setting can they perform well in the ESG areas that are most relevant to their business.

Balancing COVID with other ESG priorities

Trend

Public focus is on solving the pandemic and preparing for the post-pandemic era. But multiple stakeholders have raised concerns that the pandemic should not change or limit efforts in other ESG areas such as climate change. One example specific to the pharma industry is Bill Gates in his August 2020 GatesNotes reminding pharma companies not to lose track of malaria as COVID spreads.

That being said, the COVID crisis does seem to be leading to certain long-term priority shifts. According to the 2021 MSCI Investment Insights Report, the “S” in ESG is gaining importance for investors.

Implications

Companies need to confirm or update their ESG priorities in light of the COVID crisis. This requires differentiation between temporary and permanent changes, something that may not yet be apparent for all areas and needs to be continuously monitored. Any planned changes to a company’s ESG strategy need to be harmonized with stakeholders’ expectations. As the situation continues to evolve rapidly, traditional materiality assessment processes may be too lengthy to detect COVID-related trends in a timely manner. More agile stakeholder dialog formats will be required, possibly supplemented with continuous stakeholder document screening through natural language processing tools.

Expected action

Companies will be expected to

- commit to the continued appropriate prioritization of all material topics.

- employ agile stakeholder materiality and stakeholder dialog formats.

- make transparent if and how COVID is affecting ESG priorities.

Outlook

COVID is impacting companies across industries, but some trends are affecting the pharma industry in particular. Although part of the changes we are seeing will prove to be fleeting, the ones described in this article are deemed to have lasting effects well beyond the end of the pandemic. Pharma companies’ handling of the crisis will be under particular scrutiny, and it will have a long-term impact on the industry’s reputation. As the ESG reporting season is starting, the evolvement of ESG ratings is becoming clearer. Most new ESG requirements that emerge in this post-COVID period will not represent major challenges for companies – the path toward meeting investors’ expectations will be clearly laid out. But in other areas, simply “ticking the boxes” will not be sufficient and more far-reaching action is required. There are new long-term strategies to be developed, R&D business models to be revised, and access challenges to be met. Each pharma company will need to find its own unique approach preparing for the future.

We may not know what exactly the challenges ahead will look like, but we can be certain that COVID has not been the last crisis. With this fact established, investors expect companies to develop possible future scenarios and prepare accordingly. Particular attention must therefore be paid to investors’ increasing demands in the areas of latent trend management and long-term strategy formulation. Companies will do well to move beyond routinely fulfilling ESG rating requirements. The new focus needs to include continuous trend monitoring, e.g. through dynamic materiality assessments and close stakeholder dialog. Based on the results, companies need to formulate and track KPIs tied to the material issues identified. Furthermore, they should be ready to consider far-reaching implications for the company’s business model governance structures.

Author CVs

Dr. Michael Fürst has more than 20 years of management and leadership experience in Corporate Responsibility (CR), ESG, social business & innovation and integrity & compliance management, in business and academia.

Thomas Scheiwiller is an independent advisor and board member. He is an internationally recognized expert in the areas of governance, integrity, sustainability, and compliance. Thomas co-founded and co-leads the Biopharma Sustainability Roundtable (https://biopharmasustainability.com/), and is member of the Executive Board and Charmain of the Advisory Board at the Center for Corporate Reporting CCR (www.corporate-reporting.com)

Steffen Rufenach is CEO of R.A.T.E. GmbH. For more than 15 years, he and his team have been advising companies on using data to improve communication with stakeholders. He is a proven expert in reputation rankings and helps his clients to manage their ESG ratings performance. In addition, he supports clients in measuring the impact of their employee engagement programs.

Judith Exl is a Sustainability Consultant at R.A.T.E GmbH. She has over 5 years of experience in pharma and sustainability. She leverages her specialization in ESG, materiality, and impact measurement to advise corporate clients across various industries on ESG performance optimization and sustainability strategy.

Background on the authors' organizations

R.A.T.E. GmbH is a boutique consultancy specialized in sustainability, communication performance measurement, and global management of ratings & rankings including ESG.

The Biopharma Sustainability Roundtable is s a sector-specific platform designed to connect and support senior biotech and pharma executives in driving their Biopharma sustainability agendas forward (www.biopharmasustainability.com)